In today’s ever-evolving job market, job security is a concern for many. Recognizing this, the UAE has implemented a protective measure for its workforce with the introduction of the Involuntary Loss of Employment (ILOE) Scheme under Federal Decree Law No. 13 of 2022. This innovative insurance scheme offers a safety net for employees facing involuntary job loss, ensuring they have financial support until they secure new employment. Here’s a simple guide to understanding ILOE insurance, its benefits, eligibility, and how you can check your ILOE insurance status.

What is ILOE Insurance?

ILOE insurance is designed to support employees who have lost their jobs for reasons beyond their control, such as company downsizing or economic downturns. It excludes cases of dismissal due to disciplinary action or voluntary resignation. Eligible employees receive a monthly cash benefit of up to 60% of their average basic salary of the 6 months preceding their unemployment. This compensation is available for up to 3 consecutive months for those who have paid the monthly premium for at least 12 consecutive months.

Who Offers ILOE Insurance?

Dubai Insurance (PSC) is the authorized insurer to issue ILOE policies on behalf of the ILOE Insurance Pool. Being licensed by the UAE Central Bank and listed on the Dubai Financial Market, Dubai Insurance ensures a reliable and regulated provision of ILOE policies.

Who is Eligible?

Both Emiratis and expat residents working across the federal government and private sectors are eligible to subscribe to this scheme. This broad eligibility criterion aims to cover a significant portion of the UAE’s working population.

Compensation Benefits

- Category A: For those earning a basic salary of 16,000 AED or below, the compensation benefit is up to 10,000 AED per month.

- Category B: For those with a basic salary above 16,000 AED, the compensation can go up to 20,000 AED per month.

- Compensation is capped at 3 months for any single claim and a total of 12 months over the insured’s work life in the UAE.

Subscription Channels and Payment Options

Subscribing to ILOE insurance is straightforward and accessible through various channels including the ILOE portal, mobile app, and other channels like Al Ansari Exchange, Tawjeeh & Tasheel, SMS, Bank Apps and Kiosks (UPAY), and ATMs (C3 PAY). Payment options are flexible, offering monthly, quarterly, semi-annually, and annually plans.

Mandatory Subscription

Subscription to the ILOE scheme is mandatory for all employees in the private and federal government sectors, ensuring widespread protection across the workforce.

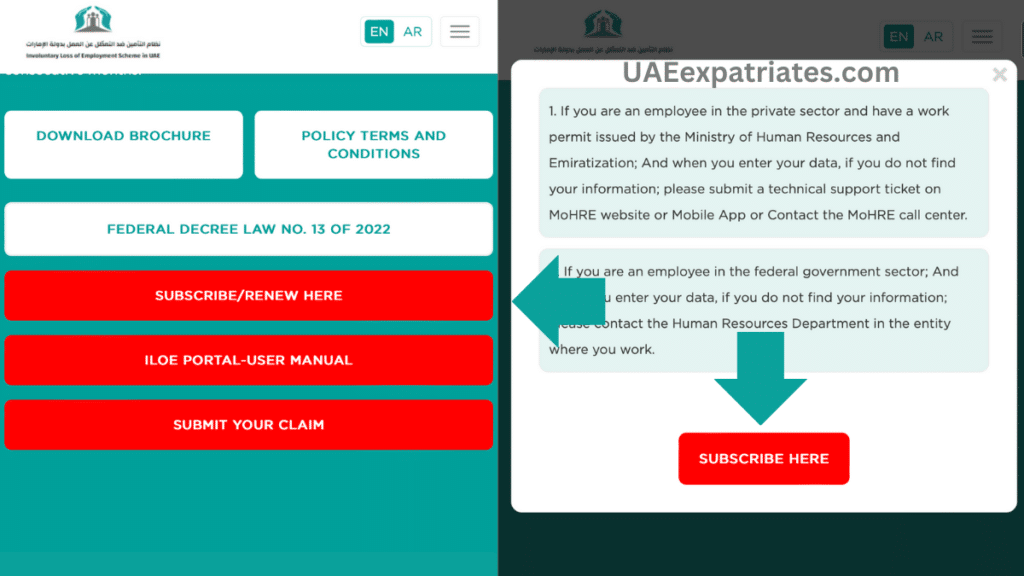

How to Check Your ILOE Insurance Status

To ensure you are covered, checking your ILOE insurance status is crucial. Here’s how you can do it:

- Visit the official ILOE website at https://www.iloe.ae/.

- Click on “SUBSCRIBE/RENEW HERE” and then select “SUBSCRIBE HERE”.

- Choose your sector (Private, Federal Government, Non Registered in MOHRE).

- Enter your Emirates ID and mobile number, then request an OTP to log in.

- Once logged in, you can view your ILOE policy details, including the expiry date and validity.

Conclusion

The ILOE insurance scheme represents a significant step towards enhancing job security and providing a safety net for the workforce in the UAE. By understanding the benefits, eligibility criteria, and how to check your insurance status, you can ensure that you are adequately protected in the event of involuntary job loss. Remember, staying informed and proactive about your ILOE insurance status is key to securing your financial stability during uncertain times.