Emirates NBD, a leading banking group in the UAE, offers innovative financial solutions to its customers through a wide network of branches and digital banking services. With the Emirates NBD X Mobile Banking App, opening a new bank account is as easy as tapping on your smartphone screen. This guide will walk you through the simple process of opening an account with Emirates NBD, ensuring you can do so from the comfort of your home.

What You Need to Know Before Starting

Before diving into the account opening process, let’s ensure you meet the basic requirements:

- Age: You must be at least 21 years old.

- Identification: Have your Emirates ID and Passport ready.

- Contact: A UAE mobile number is necessary.

- Income: A minimum salary of AED 5,000 is required.

- Selfie: Be prepared to capture a selfie for identity verification.

Also Read: How to Open a New Account with Dubai Islamic Bank Online

Opening Your Account in Minutes

Ready to get started? Follow these steps to open your Emirates NBD account:

Download the App: Search for the ENBD X Mobile App on the App Store or Google Play Store and install it on your smartphone.

Start the Process: Launch the app and tap on the “Open Your New Bank Account” option.

Get Started: Scroll down and click on “Get Started” to proceed.

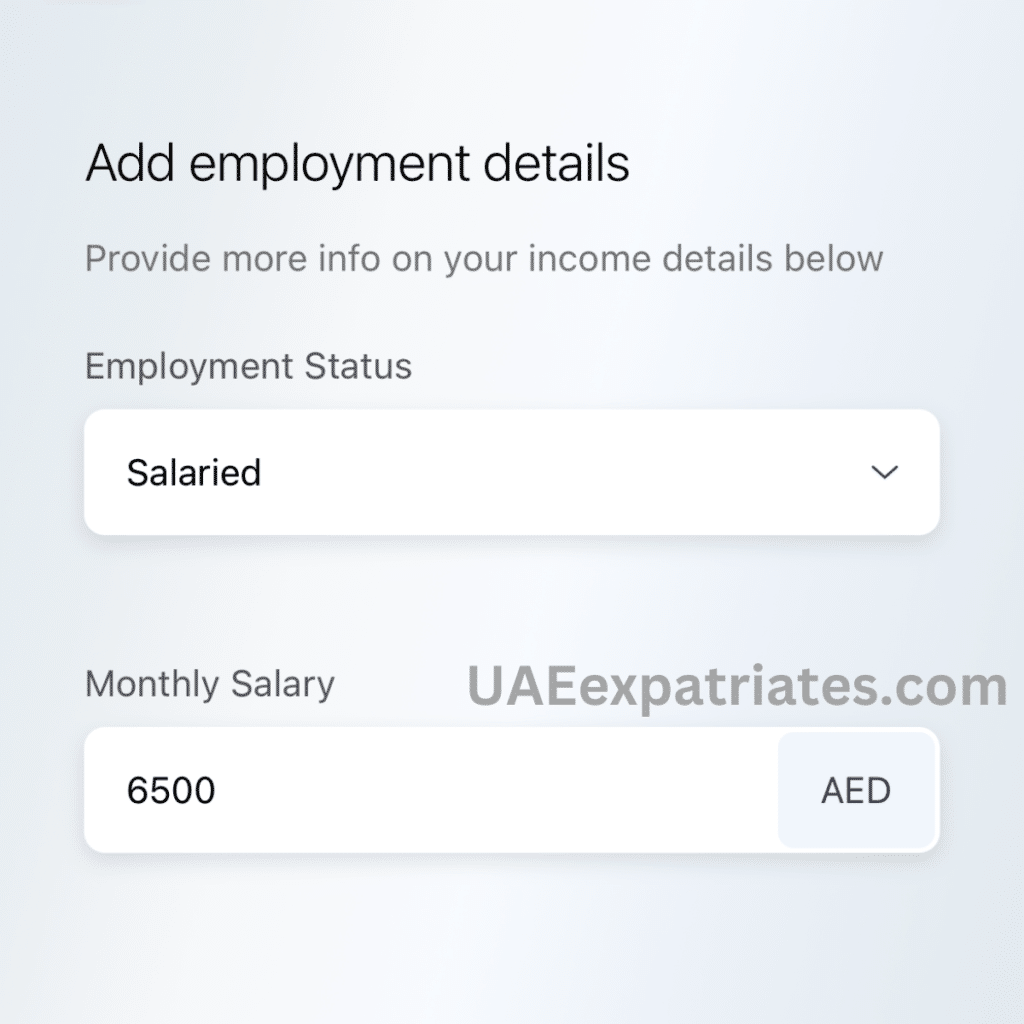

Employment Type & Monthly Salary: Select your employment type from the options (Salaried, housewife, self-employed, student); Enter your monthly salary details and tap “Next.”

Terms and Conditions: Carefully read the terms, then drag the slider to the right to agree.

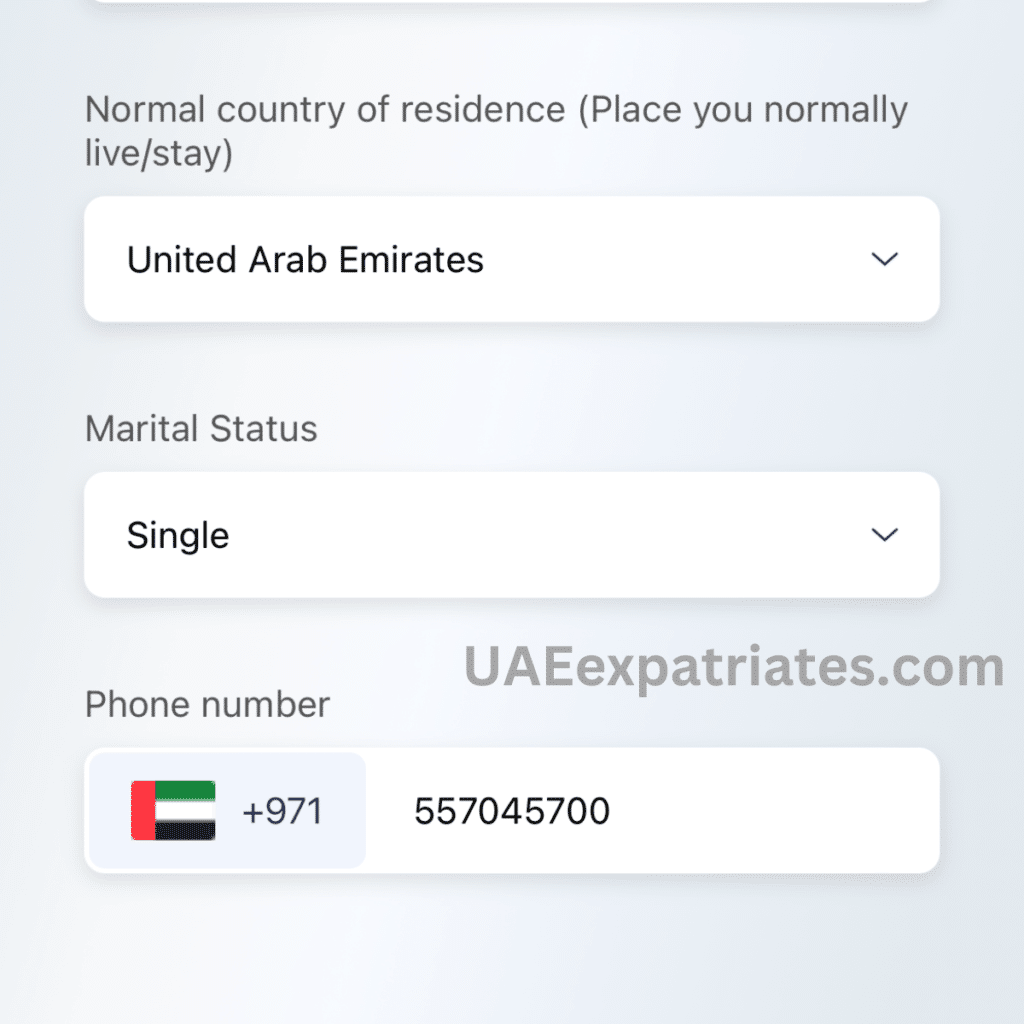

Personal Details: Fill in your country of birth, country of residence, marital status, and UAE mobile number, then click “Continue.”

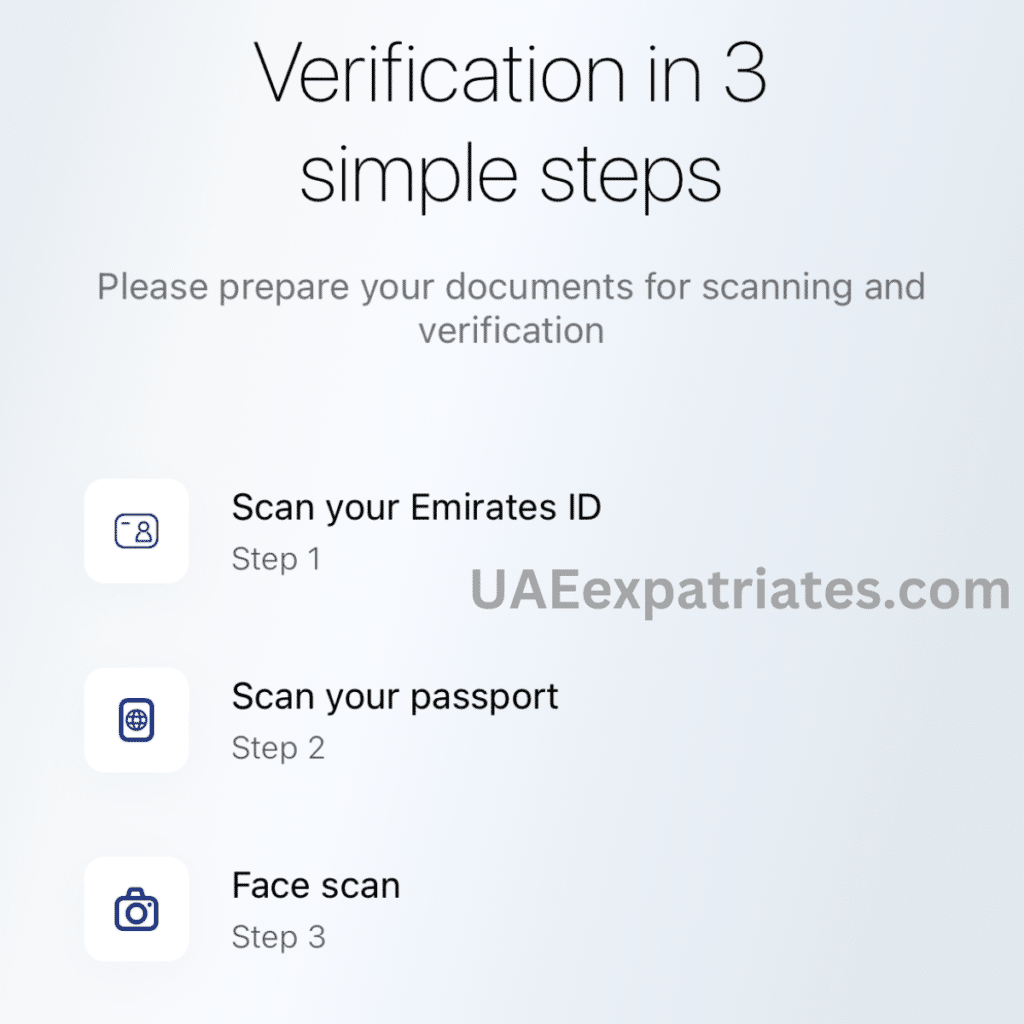

Document Upload: Scan or upload your Emirates ID and passport. Complete the face scan for identity verification.

Upon completion, you’ll see a confirmation message on your screen with your account number, IBAN, and SWIFT/BIC code. The bank will contact you shortly, and you’ll receive your welcome kit, including a free ATM debit card and chequebook, within a few days.

Related Article: 4 Easy Ways to Check Your Emirates NBD Transaction History

Why Choose Emirates NBD?

Opening an account with Emirates NBD is just the beginning. Here are some of the benefits and features you’ll enjoy:

- Comprehensive Mobile Banking: Conduct most transactions directly from your phone.

- Contactless Payments: Enjoy the convenience of Apple Pay, Google Pay, Samsung Pay, and more.

- Cardless Cash Withdrawals: Withdraw cash from ATMs without needing your card.

- Instant Transfers with MePay: Send money to friends instantly.

- Customizable Online Banking: Tailor your banking experience to suit your needs.

- Fast and Free Remittances with DirectRemit: Transfer money back home in 60 seconds at no cost.

- Advanced Security: Benefit from CHIP & PIN security, DoubleSecure online protection, and zero liability for unauthorized payments.

- Convenient Bill Payments: Pay all your utility bills through the mobile app.

- Extensive ATM and Branch Network: Access over 750 ATMs and more than 90 branches across the UAE.

- International Access: Enjoy international ATM access and merchant acceptance when traveling.

Also See: How to Check Your FAB Ratibi Card Balance: 4 Easy Steps

With Emirates NBD, you’re not just opening an account; you’re unlocking a world of financial convenience and security. Follow the steps outlined above to start your journey with Emirates NBD today.